(Image source from: Budget 2015)

The Modi government repeated its way of long-term and sustainable approach with no short-term reliefs like new tax slabs and urgent policies. The results of the budget can be seen after several years. It has paved way for universal social security and pension schemes. FM has Prioritized defence, business, investment, educational institutions, and cleanliness.

Arun Jaitley has clearly followed irregular and unconventional method to present the money bill. It has ingredients like imprisonment to tax-evasioners, reduced corporate tax, national level market for farm produce, abolition of wealth tax, extra 2% tax for super rich category, focus on J&K, institutional setups, and tourism improvements.

However, the common man cannot understand what really he is getting, unless having the analytical skills. Setting up of MUDRA bank for encouraging first generation SC/ST entrepreneurs, is really a different move that can envisage proper results.

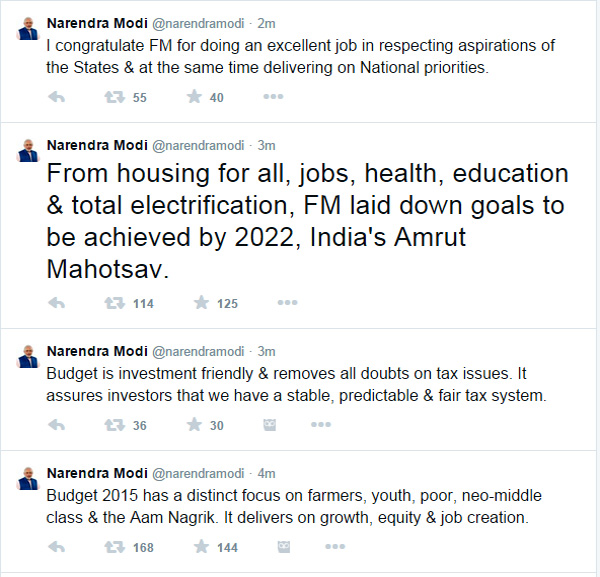

Easing tax methods for business classes and budged also covered some issues of the states in health, education, sanitation and industrial platforms. Prime Minister Narendra Modi and BJP top brass have praised the work done by the Finance Minister, while opposition criticized as usual.

The numbers found in Budget are:

• Transport allowance increased to Rs. 1600 per month

• 100% tax deduction for contribution to Swachh Bharat Fund

• Service tax hiked to 14%

• To increase clean energy cess to Rs. 200/tonne of coal

• Online excise & service tax registrations in 2 working days

• Rs. 9000 cr from additional 2% surcharge the super rich

• Wealth tax abolished, replaced by 2% cess on super rich

• Total wealth collection in the country is Rs. 1008 cr

• GAAR to be deferred by 2 years

• To curb benami transactions in property deals

• 7-yr imprisonment for non filing of return on foreign asset

• 300% penalty on concealing income

• Undisclosed income to be taxed on maximum marginal rate

• New law to tackle black money

• Exemptions for individual tax payers to continue

• Reduce corporate tax from 30 to 25 %

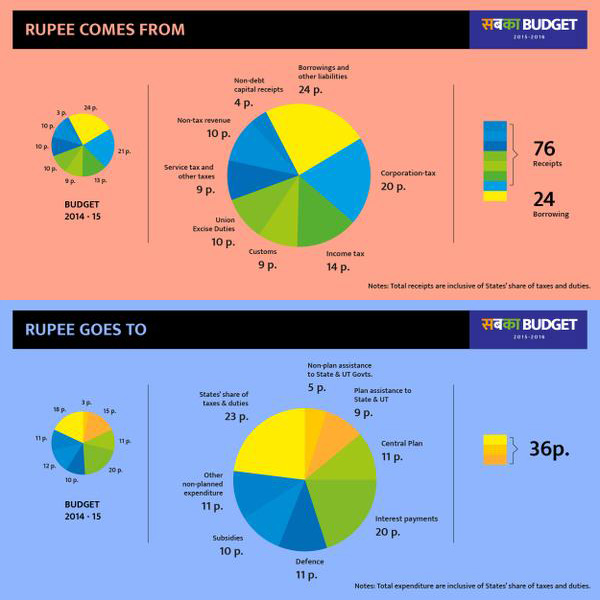

• Gross tax receipts Rs. 14.49 lakh cr

• Rs. 13,12,200 cr non planned expenditure

• Rs. 2,46,726 cr allocated for defence

• Centres for film production in Arunachal Pradesh

• Set up AIIMS in J&K, Tamil Nadu, Himachal Pradesh and Assam

• To amend law under FEMA on capital account transactions

• National skill development mission to be launched

• Plan 175,000 MW renewable energy by 2022

• Visa on arrival extended to 150 countries

• Rs. 1000 cr more to the Nirbhaya fund

• Develop sovereign gold bond with fixed rate of interest

• Introduce a gold monetisation scheme

• Direct tax regime which is internationally competitive

• Highest ever allocation to MNREGA

• Public debt management agency

• Pre existing regulatory policies instead of prior permissions

• 5 ultra-mega power projects, each of 4000MW

• Under new PPP model Govt to absorb majority of the risk

• New scheme called Nayi Manzil to enable minority youth

• Investment in infrastructure to go up by Rs. 70, 000 cr

• Integrated education and livelihood scheme for minorities

• New scheme for assisted living devices for BPL senior citizen

• To create a senior citizens' welfare fund

• To increase access to formal credit system

• Universal social security system to be created

• To create micro unit development finance unit MUDRA Bank—sc/st entrepreneurs

• Rs. 25,000 cr for rural infrastructure development fund

• National unified market for farm produce

• Initial allocation of Rs. 34699 cr under MNREGA

• Rs. 5300 cr for micro irrigation & PM's irrigation scheme

• Fiscal gap target of 3% to be met in 3 years

• Increasing investment in infrastructure is a challenge

• Our objective is to keep inflation below 6 %

• Total transfer to the states will be 62%

• Need to be mindful of fiscal discipline

• Will Form A Monetary Policy Committee

• At least 1 member of each family to have job by 2022

• Electrification of remaining 20,000 villages by 2020

• GST will put in place a state of the art taxation system

• Aiming for double digit growth

• Growth In FY16 Seen Between 8-8.5%

• Growth expected between 8 and 8.5%

• To Roll Out GST On April 1, 2016

• GST To Put In Place State Of Art Indirect Tax System By Apr, 2016

• FY15 Real GDP Growth Seen At 7.4%

• FY15 CAD Seen Lower Than 1.3%

• 50 lakh toilets constructed, target 6 cr toilets

• India's Economic Credibility Re-established

• 12.5 cr families under Jan Dhan Yojna

• 2015 GDP seen at 7.4%

For the complete Budget details Click here ..

-Kannamsai