Sometimes the hardest thing about saving money is just getting started. It may seem to be difficult to plan for your savings and to set your financial goal. This step by step guide can help you develop a realistic savings plan.

Make a record of your expenses

At first you have to know, how much you are spending in a month. Keep a record of everything you spend. Once you get your data, organize them in categories like gas, grocery, transport etc and get the total for each.

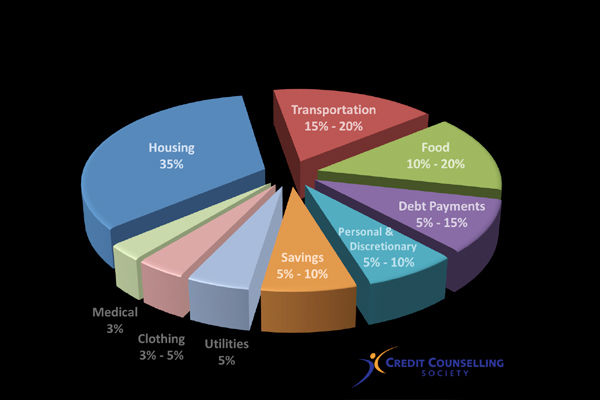

Make a Budget

Now you have a good idea about how much you spend. You can make a budget to plan your spending. Then start to limit your spending and put some money for emergency purpose every month.

Set your Savings Goal

In consideration with your monthly expenses and earnings make a savings category within your budget, and try to make this atleast 10-15 percent of your monthly net income. If your expenses wont let you save much try to cut it from nonessential expenditures like entertainment, dine out etc. Start an emergency savings plan to cover six months to year of living expenses. Save some money for vacation. Save a little for paying income tax every month instead of paying it at the end of the year.

Decide your Priorities

Different people have different sets of mind when it comes to save money for your hobbies or priorities. You have to decide how long you can wait to fulfill your dreams and how much you can put every month to help you to reach that. As you do this for all your dreams, set your priorities. Setting priorities means making choices. If you focus on saving for retirement some other goals might have to take, back seat, while you are hitting for the top targets.

Automatic Transfer

Automatic transfer to your savings account can make your savings easier. By moving money out of your checking account you may feel reluctant to spend money for savings. There are many options for setting up transfer. At first you have to decide how often you want the transfer to your savings account and how much. You can even split your direct deposit between your checking and savings accounts to contribute to your savings with each paycheck. Thinking of saving as a regular expense is a great way to keep on target with your savings goals.

Avoid Using Credit Card

Credit cards insists us to spend more. One of the main reason is, that we don’t have to pay on spot. Thus it increase our tendency towards shopping and unnecessary expenses. Try to use credit card only if you earn a very good salary, which is even more than your limits in credit cards. Avoid credit cards in the early days of your career.

Check your progress every month. This will help you stick to your personal savings plan, and this also help you identify and fix problems quickly. These simple ways may inspire you to save more and hit your goals faster.

By Prakriti Neogi