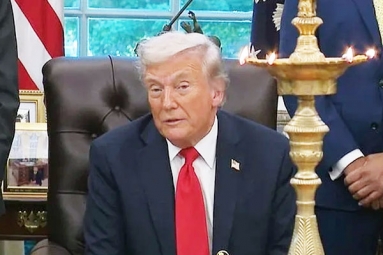

(Image source from: CNBC.com)

As United State President Donald Trump's full-time abode is the White House and not his Manhattan condo in Trump Tower, New York City authoritative recently ascertained he is no longer entitled to a $48,000 tax break, according to a report by the New York Daily News.

The tax break is acquirable to condo and co-op owners in the city, but there is a catch: "A homeowner is only eligible for the tax break if the condo is his primary residence," according to New York City Finance Department language cited by the publication. Since Trump shifted into the White House in Washington on January 20, 2017, his primary residence has been the nation's capital.

Trump received the tax break for the prior tax year because he had lived in New York through January 5. City officials have determined Trump can't take the $48,834.62 exemption, for the 2018-19 tax year.

"We have removed the exemption and have contacted the managing agent to update their records," Finance spokeswoman Sonia Alleyne told The News Thursday. "Managing agents are required by law to inform the Department of Finance of primary residency changes."

By Sowmya Sangam